That’s a very serious question. We’re in a very difficult economic situation right now in the USA, and one of the consequences might be – not “will be”, necessarily, but might be – hyper-inflation, as seen in the Weimar Republic or Zimbabwe during the past century. At the very least, a severe bout of inflation is not unlikely, even if it doesn’t reach hyper-inflation levels.

In an attempt to counter the economic effects of the coronavirus pandemic and its (mis)management, the Federal Reserve is printing money (not necessarily on paper, but by creating funds out of nothing in its computer systems) like there’s no tomorrow. This year the USA will spend upwards of $6 trillion, against a taxable income to the federal government of less than half that amount. All the rest is borrowed money, some financed by third parties buying Treasury bonds, but a lot paid for by the Federal Reserve “buying” those bonds with money that didn’t previously exist.

In due course, those bonds must be repaid. Some of that, of course, is a notional transaction. A Treasury bond owned by the Federal Reserve is paid for in binary currency generated by the Fed, not by actual banknotes, and there need not necessarily be taxes or other income generated to cover the transaction. Nevertheless, such payments reflect debt owed by the USA, part of its national debt. Right now, that national debt is very high indeed, and getting higher by the day. John Mauldin points out (bold, underlined text is my emphasis):

I’ve warned for several years now that our growing global debt load is unpayable and we will eventually “reorganize” it in what I call The Great Reset. I believe this event is still coming, likely later in this decade. Recent developments suggest it will be even bigger than I expected. You could even say I’ve been too optimistic.

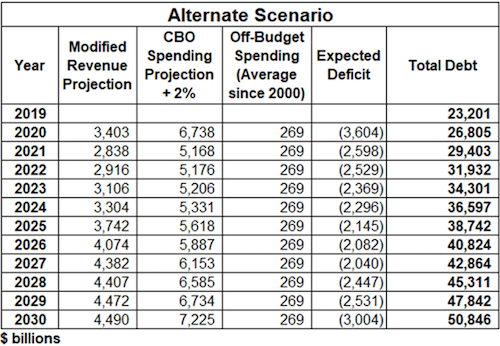

Under these … assumptions, the debt will breach $50 trillion in 2030. I bet it happens even sooner, because we probably won’t get through the 2020s without some other event blowing out the numbers—another recession or pandemic, an expensive war, who knows. But history suggests something will occur, with significant fiscal effect.. . .

The next question is how will we finance all that debt … The most obvious solution is for the Fed to buy whatever amount of bonds Treasury needs to sell using quantitative easing … And the Fed’s willingness will not be lost on a future Congress, which could easily decide to test the limit. $50 trillion could just be the start.

The other question is what effect all this federal debt will have on private markets. Will it have a “crowding out” effect that reduces private lending? How will it affect legitimate business and investment activity? We’ll see the result in lower growth.

Remember, we aren’t just talking about federal debt. States and local governments owe over $3 trillion more, plus trillions more in unfunded state pension liabilities, some of which could easily end up at the Fed or Treasury. Then there are the wildly underfunded pensions (both government and corporate) that could easily default and force some kind of federal takeover. Plus corporate bonds, mortgages, student loans, auto loans, SBA loans…

I will probably be referring to this letter in five years when it becomes clear that the debt will be hitting $60 trillion or more as the US government takes on state and local liabilities and we find ourselves in another recession. I will be admitting that my $50 trillion projection was way too optimistic. Sigh. Double sigh.

You may be a debt-free, prudent investor but the fact remains, you are also a citizen and taxpayer. We are collectively in hock up to our ears. Some of this will end up on your shoulders and mine. Not a pleasant thought? Exactly.

. . .

I was explaining this to a friend last night. He asked me what we should do, somehow believing that there has to be an answer. There isn’t one. We have no good choices left. It is as if we are on a trip through a desert and know for certain we don’t have enough water to go back. We don’t know where the desert ends, but we have to go forward.

That’s the reality. Unless you want to cut Social Security and Medicare, ignore military pensions, sell the national parks, abolish departments like State and Treasury, cut the defense budget in half along with Homeland Security, Education, Labor, the Justice Department and the FBI, etc. we are going to have to live with the $2 trillion deficits. In good years. There are no better choices.

We are going to learn how much the US can borrow before it all collapses around our ears. I have no idea where that point is.

There’s much more at the link (including larger versions of the graphics shown above). Highly recommended reading.

The accrual of unsustainable government debt is precisely what sparked hyperinflation in the Weimar Republic.

The cause of the immense acceleration of prices seemed unclear and unpredictable to those who lived through it, but in retrospect, it was relatively simple. The Treaty of Versailles imposed a huge debt on Germany that could be paid only in gold or foreign currency. With its gold depleted, the German government attempted to buy foreign currency with German currency, equivalent to selling German currency in exchange for payment in foreign currency, but the resulting increase in the supply of German marks on the market caused the German mark to fall rapidly in value, which greatly increased the number of marks needed to buy more foreign currency.

That caused German prices of goods to rise rapidly, increasing the cost of operating the German government, which could not be financed by raising taxes because those taxes would be payable in the ever-falling German currency. The resulting deficit was financed by some combination of issuing bonds and simply creating more money, both increasing the supply of German mark-denominated financial assets on the market and so further reducing the currency’s price. When the German people realized that their money was rapidly losing value, they tried to spend it quickly. That increased monetary velocity caused an ever-faster increase in prices, creating a vicious cycle.

The government and the banks had two unacceptable alternatives. If they stopped inflation, there would be immediate bankruptcies, unemployment, strikes, hunger, violence, collapse of civil order, insurrection and possibly even revolution. If they continued the inflation, they would default on their foreign debt.

However, attempting to avoid both unemployment and insolvency ultimately failed when Germany had both.

Again, more at the link.

A similar situation – massive over-printing or artificial generation of money – was seen in Zimbabwe.

A monetarist view is that a general increase in the prices of things is less a commentary on the worth of those things than on the worth of the money. This has objective and subjective components:

- Objectively, that the money has no firm basis to give it a value.

- Subjectively, that the people holding the money lack confidence in its ability to retain its value.

Crucial to both components is discipline over the creation of additional money. However, the Mugabe government was printing money to finance military involvement in the Democratic Republic of the Congo and, in 2000, in the Second Congo War, including higher salaries for army and government officials.

. . .

The Reserve Bank of Zimbabwe responded to the dwindling value of the [Zimbabwean] dollar by repeatedly arranging the printing of further banknotes … neither the issuance of banknotes of higher denominations nor proclamation of new currency regimes led holders of the currency to expect that the new money would be more stable than the old. Remedies announced by the government never included a believable basis for monetary stability.

. . .

Over the course of the five-year span of hyperinflation, the inflation rate fluctuated greatly. At one point, the US Ambassador to Zimbabwe predicted that it would reach 1.5 million percent. In June 2008 the annual rate of price growth was 11.2 million percent. The worst of the inflation occurred in 2008, leading to the abandonment of the currency. The peak month of hyperinflation occurred in mid-November 2008 with a rate estimated at 79,600,000,000% per month. This resulted in US$1 becoming equivalent to the staggering sum of Z$2,621,984,228.

There are many economists who assert that the USA is in a different position to the Weimar Republic or Zimbabwe, because the US dollar is the world’s reserve currency. It underpins the current world economic order. We don’t have to buy dollars to pay our debts; we can simply print them. However, there are strong pressures to change that, particularly from China. If the dollar should lose its dominant position in international trade, a great deal of the support for its value would fall away. The USA would then have to buy foreign currency with dollars to purchase goods and services from those nations that preferred non-dollar payments. A weaker dollar would buy less foreign currency, greatly increasing costs – and giving rise to a greater rate of inflation internally.

There’s also the fact that massive, artificial generation of currency without underlying economic activity to justify it has been a factor in every previous incident of hyper-inflation of which I’m aware. We’re doing precisely that in the USA today, on a truly massive scale. I don’t believe it’s sustainable in the long term without similar consequences to those every previous offender has experienced.

What’s more, I see inflationary signs all around us that make me very worried. I speak from bitter experience. I come from South Africa, which suffered under double-digit inflation for decades. My starting monthly salary as a teenaged E-1 in that country’s armed forces, way back in the ’70’s, was adequate for my needs at the time. Today, that same sum will buy a basic burger (no cheese, no fancy sauces, etc.), fries and a soda at a typical South African fast food joint. I mean that quite literally. I went to the Web sites of South African restaurants and checked.

The Wall Street Journal notes:

If it feels like the price of everything you buy has been soaring, that’s because it has—even as central bankers everywhere worry about the danger of deflation.

The gap between everyday experience and the yearly inflation rate of 1.3% in August is massive. The price of the stuff we’re buying is rising much faster, while the stuff we’re no longer buying has been falling, but still counts for the figures.

. . .

If the government and Congress take up the free money from the Fed to finance more stimulus, this summer’s price rises could continue and become a serious worry for investors.

Equally, if the second wave of Covid-19 is followed by a third, heavy job losses and renewed recession could threaten demand and so prices again. In Europe, the three-month inflation rate fell back to exactly zero in August as a second wave hit Spain and France.

Maybe the government will deftly manage its way through the virus and the economy, providing stimulus when needed and pulling back just the right amount to prevent inflation picking up too much. Much more likely is that it goes wrong and we end up with too much or too little stimulus.

The test of that will be in how much inflation we actually get, and which parts of the economy feel it most.

I’ve argued for a long time that the “official” rate of inflation in the USA bears little or no relation to the actual rate. Private sources such as Shadowstats or the Chapwood Index make it clear that the real inflation rate for most US consumers has been hovering around the 10% mark for years. That’s certainly borne out by my experience, watching our grocery and household expenses climb over time. (Sadly, that climb in costs has not been matched by a corresponding rise in our household income. I daresay most of my readers can say the same. Most of us are worse off today than we were ten or twenty years ago, by that measure.)

I don’t know for sure that higher inflation is coming, but when I look at the “signs of the times”, and the lessons of history, and my own experience in South Africa . . . I’m seriously worried. I think we may be closer to at least high inflation, if not hyper-inflation, than we like to think. If the US dollar should lose its status as the world’s reserve currency, that danger will become much greater – and very quickly. It’s astonishing how fast hyper-inflation can affect fiat currencies, which have no intrinsic or underlying value to support them. Look at the value of the Weimar Republic paper mark (i.e. fiat currency) over time, compared to a single gold mark (i.e. with underlying value) (image courtesy of Wikipedia):

The US dollar has already lost 94% of its value over the past 76 years. Who’s to say that in three to five years, we might not be facing a total collapse in its value, similar to the collapse of the Weimar mark illustrated above? Our economic fundamentals are not stable at present, and show no signs of becoming more stable. We aren’t nearly as secure as we might like to think.

I urge all my readers (if you aren’t doing it already) to start watching your weekly and monthly grocery and household bills like a hawk. Keep track of how much you’re spending on necessities, and how much on things you could do without if you had to. Watch how their price is changing over time. If that change starts to average more than 1½% to 2% per month across most of your important purchases, look out! At that point, economic hard times will likely be inevitable. They won’t just be a loss of purchasing power, either: companies will have to lay off workers and cut expenses to the bone in order to survive. Many of those currently employed will find themselves out of work, without an income to buy increasingly expensive goods. That’s already happening in Latin America. Don’t ignore that link – go read what’s happening to people all over that continent.

I’m already seeing a few consumer prices rise more than 1% per month over the course of this year. If and when the majority of prices show the same trend, I think it’ll be a sign that we’re facing very difficult inflationary times. At that point, spend your money wisely, buy what you really need rather than what you merely want, and stock up on essentials before they get even more expensive. The “preppers” among us, who’ve built up a reserve supply of food and essentials, will be better equipped than most to ride out such a storm, but even their supplies won’t last forever.

What can high- and hyper-inflation do to us?

- In Zimbabwe, people rushed to the shops, inches-thick wads of cash in hand, to buy what they need before their money became even more worthless.

- In South Africa, I once bought a can of food (imported) with three price stickers on it, each superimposed on the one before it. The price I paid was more than 50% above the price on the first (bottom) price sticker.

- In the Weimar Republic, children played with bundles and stacks of banknotes, because their value was so small there was nothing better to do with them. Go look at the images in this article. They’re eye-opening.

Food for thought, no?

Peter

Watch precious metal prices, gold and silver are the go-to for holding wealth when fiat money collapses. Perhaps buy some silver if your preps are good. I won't buy gold, FDR took the family gold and impoverished us.

First, buy the goods you will need.

Don't overlook the fact that paper investments are just paper, be the underlying asset be gold, silver or anything else.

When the wheels come off do you really expect anybody to be standing behind the paper or will they grab what real assets there are and head for the hills.

Paper investments are easier to confiscate too, quietly purchased real assets are much easier to keep under the government's radar, well if you can keep from bragging. Your best buddy may have to choose hungry kids or a reward for turning you in. Don't put either of you in that place.

I agree that inflation is growing an that the growth of the federal deficit is a bad thing – but I don't think that hyper inflation will come that fast due to the US having a MUCH stronger economy than Weimar or Zimbabwe had, not to mention that the US has far fewer government jobs…

BUT this assumes there is no big increase in entitlements or large economic downturn.

I know some liberals who blame the military for the budget deficit – they don't like it when I point out that eliminating the military and all 'discretionary' spending, there would still be a deficit… And of course, this year all of the COVID spending has thrown a further wrench into things…

Back in the Carter years, as my earnings stayed the same in nominal dollars, and I went from upper middoe income to lower middle, I collected a set of Weimar currency, finding b the highest denomination I could for each month between January 1921 and March 1923, when it all fell down. These range from a nice 100 Mark note to a 20 Trillion Mark note that looks like it was printed with a potato.

The hardest thing to find when we face our crash will be trust.

Peter and others have written of the diffrrences between high trust and low trust societies, and how those factors affect the economic strength of the society.

Good luck. I think that we will need it.

John in Indy

You can't have Capitalism with electrons instead of capital.

Total hard assets in the USA are ~$275T. Net worth is ~$125T. These debt numbers are noise.

Perhaps we can't do this forever, but we can do it for the foreseeable future. And who says it has to be repaid? Most of these "debt" numbers are just creating real assets at a modest, sometimes significant, multiplier.