A conflicting picture is emerging of the US economy. It seems that households are economizing and paying off debt, while the government is taking on ever more debt and spending like there’s no tomorrow.

First, consumers. CNBC reports:

Consumers’ out-of-control debt loads helped spark the recession, but households are rapidly getting their balance sheets back into shape.

. . .

Consumers went into the recession carrying debt of nearly double the nation’s gross domestic product. That’s down to below 85% now, and on pace to approach 75% by late next year, Moody predicts.

Harvard economist Kenneth Rogoff said consumer debt is now headed in the right direction, but cautioned it might not translate quickly into more economic growth.

“The thing everybody grapples with is, ‘How much (debt) is normal?’ ” Rogoff said. “There will be a long memory of this crisis. It may be the biggest question mark in terms of trying to time this recovery.”

Revolving debt, mostly credit cards, has fallen 19% since 2007. Revolving balances dropped at a 6.8% seasonally adjusted annual pace in July, after falling 4.5% in June, the Fed said last week. Non-revolving debt has risen, mostly because of student loans.

If consumer spending doesn’t come back strongly, it might be because incomes are still well below where they were before the recession, and that households lost about $7 trillion of home equity as housing prices plummeted. That could make them keep the brakes on spending for a while longer, Hoyt said.

There’s more at the link. Bold print is my emphasis.

What this report doesn’t tell us is how that debt load dropped so precipitously. Sure, some households have been paying down debt (my own among them): but far more have reduced their debt load by simply defaulting on it – walking away from houses that were ‘underwater‘, not paying credit card bills or other debts, and in some cases declaring bankruptcy. This has been even worse for the economy than if they were still carrying that debt, because such debt doesn’t disappear. It’s carried on corporate books as bad debt, which the company will try to recover by raising the prices it charges other, non-defaulting customers. This also has the effect of making credit harder to obtain. Financial institutions that experience massive customer defaults are much less willing to make loans to other potential defaulters!

NerdWallet sums up credit card debt as follows:

In 2010, credit card companies wrote off seriously delinquent debts in earnest, lowering the total amount of revolving credit card debt. The charge-off rate – the percentage of dollars owed that issuers have written off as uncollectable – rose to 10.9% in the second quarter of 2010. This represented an increase of over 300% from the first quarter of 2006, when the charge-off rate was only 3.1%. Charge-offs account for a significant portion of the debt reduction.

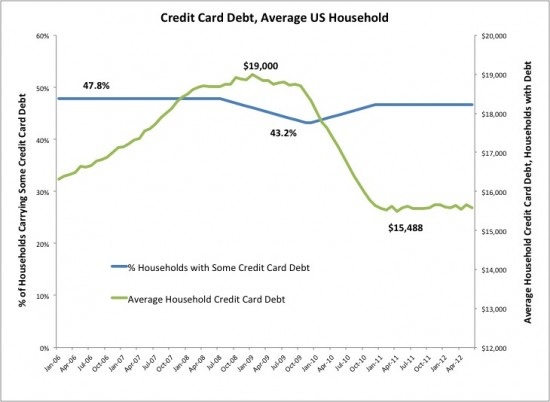

The graph says it all: between the fourth quarter of 2009 and the fourth quarter of 2010, average household debt fell by $2,722. The speed with which average debt fell indicates that loans were written off, rather than paid off. As a result of those losses, spooked credit card companies tightened their purse strings. Stricter lending standards also contributed to a fall in total credit card debt. Those two factors – fewer loans, made to more creditworthy consumers – are troubling, as they speak to a one-off correction rather than an improvement in underlying factors such as increased income or fiscal prudence.

Again, more at the link. It’s well worth reading.

(Note, too, that many US consumer debts have been ‘federalized’ – taken over by the US government, so that they’re now ‘owed’ by all US taxpayers. This is what the Fed is doing with the latest round of quantitative easing. It’s buying up to $40 billion of mortgage-backed securities each month . . . and those mortgages are held by US residents who are frequently less than able to pay them. The result? You and I, as taxpayers, will be on the hook to pay for those mortgages that go into default, because the Fed now owns them – and we’re legally responsible for settling the Fed’s debts. Charming, isn’t it?)

The problem, of course, is that there are no such credit or spending restraints on the US government. In fact, the Federal Reserve is now enabling almost the whole of our budgetary deficit, because there are few (if any) other buyers for US treasuries. CNBC again:

The latest round of extraordinary Federal Reserve stimulus is risky and leaves little room to maneuver should another crisis hit, economist Lawrence Lindsey told CNBC’s “Squawk Box” on Wednesday.

Lindsey said that with the Fed purchasing at least $40 billion a month in mortgage debt through QE3, “they are buying the entire deficit.”

. . .

Lindsay said he agreed with the Fed’s first two rounds of quantitative easing. Now, with the economy now growing closer to its trend rate, “doing something that’s really out of the ordinary is risking things.”

He added, “If this becomes the new ordinary, it’s hard to imagine the Fed’s maneuvering room” should another crisis hit.

The central bank’s recently announced bid to stimulate the economy has also taken the pressure off politicians to deal with the U.S. fiscal cliff, Lindsay argued, which could result in destabilizing tax hikes and spending cuts automatically taking effect early next year.

“The Fed, maybe because it can’t do otherwise, has told the Congress: ‘We’re going to buy your bonds no matter what,’” Lindsey said … Why would any Congress not borrow and spend if they could borrow at 60 basis points?”

So, the big banks are forcing austerity on consumers by demanding repayment of debt and not issuing as much new debt to replace it; but the Federal Reserve is issuing fiat currency hand over fist to keep the US government’s maniacal, out-of-control deficit spending policies afloat. One wonders why no-one in authority has seen and/or commented on the disconnect . . . because sooner or later (my money’s on sooner), the fiscal chickens are going to come home to roost.

Peter