Tonight I’d like to look at the so-called ‘debt bomb’ – and why it may be about to explode.

The ‘debt bomb’ came about because at all levels of society – Federal, State and local government, businesses, and consumers – the pressure to spend money one didn’t have became too great. Part of this was deliberate economic policy; in order to drive economic growth, there had to be a market for the goods produced, so consumption spending had to increase to create that market. Part of it was fiscal irresponsibility; in order to give benefits to certain sections of society without taxing other sections to the point of rebellion, it became necessary to borrow money to fund the benefits. Part of it was plain greed; if one wanted to ‘keep up with the Joneses‘, one had to find a way to match their possessions and/or lifestyle, and if one didn’t have the cash needed to do so, one had to finance it by going into debt.

Unfortunately, once this spiral of debt-financed spending began, it became almost impossible to slow it down, let alone reverse it. Once certain sections of the population became dependent on debt-financed government handouts, they wanted more of the same; and to ensure their votes, successive governments went further and further into debt to continue (or even increase) the benefits doled out to them. The tail-chasing of the Joneses and their neighbors led to ever-increasing debt-financed consumer spending, because very few people had the courage to tell their kids, “No, you can’t have the latest toys, and clothes, and goodies, because we can’t afford them”. If the kids saw their friends with the latest and greatest everything, they were taught (by advertisements, peer pressure and other influences) that they were ‘entitled’ to the same things. Parents who wouldn’t provide them were ‘mean’ or ‘stingy’ or – worse still – ‘poor’. (*Gasp!*) That would never do.

The effect of all this borrowing was to pull forward consumer demand. Let me illustrate. If you want to buy a car, you have two options. You can save your money over a period of months or years until you have enough, and then buy the vehicle; or you can borrow the money, buy it now, and spend the next few years paying off the debt. By borrowing the money and buying the car now, you’re pulling forward the purchase you would have made at some point in the future if you’d saved your money until you had enough to afford it. However, you’ve also saddled yourself with two things; a debt that must be repaid, and a depreciating asset that, over time, will be worth considerably less than you paid for it.

This same pattern was followed at all levels of our society. Governments – national, regional and local – borrowed money to fund programs, or finance projects, or whatever, thereby creating pulled-forward demand for the things on which they spent the money (e.g. construction firms building new structures for them, or families receiving welfare payments and, in their turn, spending those welfare payments on things they would otherwise not have been able to buy) whilst at the same time saddling future taxpayers with the debt necessary to pay for these things now. Companies did the same, issuing bonds or raising loans to finance expansion, new products, etc. Individuals and families did likewise, borrowing money against the security of their homes, or taking out lines of credit, to afford consumer goods now, rather than wait to buy them for cash. In every case, consumption was pulled forward artificially. The economy would never normally have been able to afford all the goods and services consumed if they’d been paid for by savings. However, debt financing meant that they could be paid for now, so industrial and commercial production increased all over the world to satisfy the artificial pulled-forward demand thus created.

The result of such profligacy is now showing at every level of our society. Let’s start with government. So many programs and projects and handouts have been financed by debt that many governments are now hopelessly overstretched. They can’t make the payments due, so they’re trying to ‘roll over’ their debts (i.e. issue new debt – bonds, promissory notes, whatever – to replace old debt now falling due, instead of paying it off, because they don’t have enough money to do so). Unfortunately, every sector of the economy is in the same boat, and everyone’s trying to ‘roll over’ debt; so the cost of doing so (i.e. the interest that has to be offered on the new debt to make it attractive to investors) goes up exponentially. Furthermore, if one nation defaults on its debt, or appears in danger of doing so, this exposes the real risk that others will do likewise, making investors reluctant to accept new debt instruments in exchange for their old ones. They’d rather have cash, thanks very much. I don’t blame them.

Precisely the same criteria now apply to individuals. Far too many families have lived up to their eyeballs in debt. We’ve all heard the horror stories about people drawing cash out of one credit card in order to pay the minimum balances due on their other cards, or taking a second or third loan against the equity they’ve built up in their home to pay off other debt. That sounds like a reasonable idea, as long as the value of their home equity remains positive. If that value slips, they have no equity left against which to borrow; and, in many cases, where they’ve already borrowed against that equity, they now owe far more money than the underlying asset (their home) is worth. Their mortgage(s) is/are now ‘upside-down’, to use the market term: the loan amount exceeds the value of the asset.

To add to the problem, as credit dries up, the ‘pulled-forward’ consumption that had been financed by that credit can no longer take place. Companies are finding themselves sitting on huge stockpiles of goods they can’t sell and/or services they can no longer provide, because no-one can afford them. Those trying to sell their homes are finding that prospective buyers, denied easy and expansive credit, can no longer afford the inflated prices once charged for those homes. They’re offering much less for them. Housing prices have dropped considerably, and I confidently expect them to drop a whole lot more before this is over. In a few of the worst-hit areas, I’m willing to bet that the average house will be worth less than half as much in 2011/12 than it was in 2007/08, at the start of this depression/recession cycle.

One result of this has been a vast increase in the number of people who can no longer pay their bills. Their assets are worth less, so they can’t borrow against that security any longer. The companies that hired many of them no longer have as large a market for their goods, so they’re producing less and retrenching workers they no longer need. The inevitable result is that corporate and individual bankruptcies are burgeoning, and even where bankruptcy is avoided, people are walking away from loans they can no longer afford to pay. According to some estimates, there are between two and three million properties in the US alone which are either already repossessed, or in the process of repossession, by banks and mortgage holders. All are now worth less than the loans issued to buy them, which means that lenders are (or soon will be) taking a bath on each and every one of them.

This has wider implications. I spoke of the ‘pull forward’ effect of debt financing of purchases. When credit dries up, it exerts an opposite influence – a ‘push back’ effect – on production. Let me explain by analogy. Joe Consumer buys a car every five years, using credit. Now, suddenly, he doesn’t have access to cheap credit any longer. He can certainly save his money to buy another vehicle; but before he can do that, he has to pay off his existing loan. It’ll take him five years to do that, plus another five years to save enough to buy another new vehicle. In other words, his next purchase is pushed back from five years in the future to ten years ahead. He may also not buy as expensive a vehicle; he might buy a cheaper model, or a used car instead of a new one. This is a simplistic analogy, admittedly, but it covers the major points.

This has a major impact on manufacturers. Their production plans are based on selling a given number of widgets (cars, refrigerators, computers, whatever) each year. If credit dries up so that consumers can no longer buy their products as easily, they have a huge problem. They’ve invested in factories, employees and supplies to produce enough widgets to satisfy normal demand (including the ‘pull forward’ effect). Suddenly, the demand evaporates. They now have to cut back on all those elements if they’re to survive. That’s why unemployment can become so great a problem, so quickly; it’s the quickest and easiest means for manufacturers and suppliers to save money. They can’t necessarily dispose of factories, or production machinery, or raw materials in a hurry; but they can cut their payrolls, and they’ll do so as rapidly and ruthlessly as they have to in order to survive.

The ‘push back’ effect thus hammers those who produce and sell consumer goods, and also their now-unemployed workers, who join the ranks of those who can no longer afford to pay their bills, or can no longer get credit to buy the goods and services they previously consumed. The whole depression/recession cycle is thus intensified.

I hope these examples illustrate how the loss of the ‘pull forward’ effect of debt financing, and its replacement by a ‘push back’ effect on purchases, has an economic impact far beyond the individual consumer. I hope they also explain why the ‘debt bomb’ is such a real and present danger. Many individuals can no longer pay their debts. Many taxpayers no longer contribute to Government coffers (because they’re out of work), and sales tax revenue also decreases (due to lower sales), so local, State and national government income takes a pounding. The bonds and other debt instruments those government entities have issued must still be repaid on schedule, but now they have less money coming in with which to do so. They have no choice but to ‘roll over’ the debt by issuing new bonds and debt instruments. However, because so many other entities (government at all levels, companies, banks, etc.) are all trying to do the same thing, the competition to attract investment is much tougher, meaning that incentives (i.e. higher interest rates or other benefits) must be offered to attract buyers for the bonds. The cost of credit goes up for all concerned.

One effect of the so-called ‘stimulus packages’ passed by the US Government has been to transfer debt from the private to the public sector. This has happened because, as private credit collapsed, the government deliberately incurred more debt by means of ‘deficit spending’, buying goods and services (or giving others money to buy goods and services) in an attempt to stop the economy grinding to a halt altogether. This has partly succeeded, but only at the cost of an enormous, unsupportable expansion of public debt. The Hoisington Investment Management Company points out, in its second-quarter 2010 report:

The Office of Management and Budget (OMB) projects that the ratio of government debt to GDP will jump from 53% currently to 77.2% in 2020.

Based on this substantially elevated level of debt, the government share of total GDP could exceed 25% of GDP within five years followed by even higher levels thereafter, a dramatic difference from the share in 2009. The government share of GDP has been moving higher since the 2001 recession as the Government/Debt to GDP ratio has advanced (Chart 2). At the same time that the government share of GDP has risen, the private sector share of GDP has fallen. This period of extreme underperformance of the private sector since 2001 combined with higher relative levels of government debt constitutes a clear sign that the U.S. is following the path toward economic stagnation and a lower standard of living.

Going forward, the diminished private sector must generate the resources (i.e. the funds) to service and/ or repay the increased level of debt. If the private sector is not successful in generating the additional resources needed, the government sector must either go deeper into debt or impose additional taxes on the already stressed private sector. Considerable evidence suggests that this self-defeating process has already resulted in transfers of resources from the private sector to the government sector.

In the past four quarters, total debt has dropped by a record $789 billion even though federal debt has surged by an outsized $1.45 trillion. The reconciling factor was a record $2.235 trillion contraction in private debt outstanding.

. . .

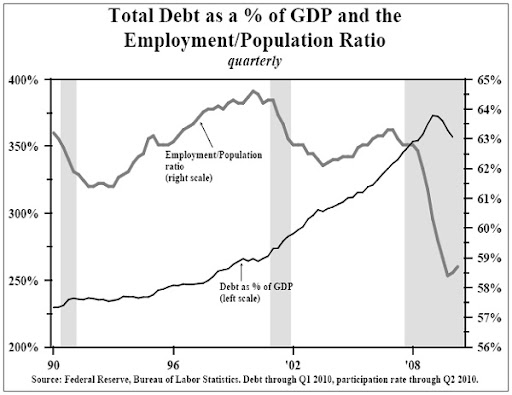

… the U.S. economy remains extremely over-indebted. In the first quarter, the total debt to GDP ratio was 357%, 100 percentage points higher than in 1998.

The best scholarly work indicates that the process of over indulging on debt ends badly – economic deterioration, systematic risk and in the normative case deflation. The private sector has deleveraged slightly either due to conditions imposed by the capital markets or their own choice.

Nevertheless, the private sector remains massively over-leveraged. Another aspect of the debt problem must be considered. The debt was used to acquire a large number of things that are no longer needed in the sense that they are not viable in view of current economic circumstances. Accordingly, the very reasonable risk is that individual private sector borrowers will not have the resources to make timely payments for debt service and amortization. The high debt ratio reflects vast amounts of unused factory capacity, office space, warehouses, retail space, and other facilities.

There’s more at the link. In order to adhere to ‘fair use’ copyright restrictions, I’ve quoted only a very short excerpt from the Hoisington report. It’s well worth your time to click on the link and read it in full.

I could go on for hours explaining the background, but I think I’ve said enough to portray the huge problem confronting us. This is now playing itself out across every sector of the economy. To name just a few points from current headlines, in no particular order:

- Small businesses, which generate a very large proportion of jobs in the economy, are finding it very difficult to get loans to expand, and thereby create jobs for the unemployed.

- Millions of consumers are finding their credit scores dropping, impacting their ability to get new loans or lines of credit.

- 48 of the 50 US States face budget shortfalls this year. More than half of them face shortfalls greater than 20% of their budget requirements, mostly due to a reduction in their income from taxation. This means they’ll either have to cut programs on which many rely, or go even further into debt (at ruinous expense) to finance them. Some States (Illinois and California in particular) are virtually bankrupt already.

- “Government policies designed to stimulate the economy seem to be having the opposite effect. Consumers aren’t buying, businesses aren’t hiring, and those fortunate enough to have some cash on hand don’t seem to be investing.” Not surprising – in an uncertain economic climate, people hold on to what they’ve got and avoid risk.

- “When the world’s productive capacities exceed the buying power of the world’s consumers, every government wants to increase exports and discourage imports. That spells trade war.” Yep. Governments do what individuals do – spend less outside the house, control tightly what they buy to bring into the house, and (in the absence of reserve funds or cheap credit) spend only what they absolutely have to.

- The availability of consumer credit continues to decrease by leaps and bounds. Banks who received ‘bailout money’ used it to cover existing bad debt and build up a cushion, a reserve, against future bad debt. They’re not lending it out; they’re keeping it for themselves and their shareholders.

- So many people are walking away from ‘upside-down’ mortgages that lenders are now threatening to pursue them to recover their losses, even though historically the only security on a mortgage loan has been the property in question. Losses are so great that lenders are no longer willing to accept that. Those currently living high on the hog by spending the money they used to devote to their mortgage payment each month are likely to be shocked (and left completely broke) when they find themselves held liable by the courts for the mortgagor’s losses.

- The wealthy are abandoning their mortgages and over-priced homes at a rate far greater than the average consumer. They’re wealthy, after all. They don’t mind moving out of an overvalued home that they over-financed; they can still afford a decent lifestyle using their reserves. However, by doing that, they’re affecting millions who have less income, fewer reserves, and who can no longer get credit because banks are having to use bailout funds to cover their losses caused by those who default on their loans.

- The world’s banks are facing a crisis as trillions of dollars in loans come due, but the competition for new credit to replace them (i.e. to roll them over) has become so fierce that the necessary credit lines may not be available.

- “The co-chairmen of President Obama’s debt and deficit commission offered an ominous assessment of the nation’s fiscal future [in Boston on] Sunday, calling current budgetary trends a cancer ‘that will destroy the country from within’ unless checked by tough action in Washington.” Chances of that ‘tough action’ under the present Administration, and from the present majority in the House and Senate? Zero. Zip. Nada. Bupkis.

- Americans are paying off their consumer debt, but the fact that they’re doing so – and not borrowing more money while they’re at it – means that the credit-financed commercial and industrial sector is having to incur greater costs and risks to satisfy the declining demands in the market. (See the ‘pull forward’ and ‘push back’ effects described above.)

I hope that’s enough evidence to make my point clear. The ‘debt bomb’ has been growing, and growing, and growing. It’s finally reached critical mass. If it can be ‘deflated’ in an orderly fashion by paying off debt, all well and good: but that’s extremely unlikely, given the amounts involved. The best we can hope for is that the let-down will be as gentle as possible, over time . . . but that’s not guaranteed. Let there be just one sovereign default on debt (e.g a nation or US State declaring bankruptcy, or failing to repay a major tranche of debt on time) and the whole debt-financed house of cards may collapse suddenly, with no further warning. The odds of that happening are, in my opinion, better than even right now. Again, look at Illinois and California. Who wants to bet that neither State will default on their sovereign bonds within the next year or so?

Anyone?

Listens to sounds of crickets chirping . . .

Peter