Last night I mentioned an article in National Review Online titled “The Rich Aren’t Getting Richer”. In a spirited debate in the Comments to my article, reader Nebris went on about how this wasn’t so, and how letting “the Bush tax cuts expire” would solve most of our deficit problems, and so on, and so on. Trouble is, not only is Nebris completely, utterly wrong about this, but so are almost all the commentators on the “progressive” side of the fence. They needn’t feel bad about this, of course: most of the commentators on the “conservative” side of the fence are equally wrong.

The blunt, simple, real truth about the deficit situation is: WE’RE SCREWED.

It’s already almost too late to fix the problem: and even if we take all the essential steps right now, we’re in for at least five years (more likely a decade) of real financial pain to put things right. If we don’t take those steps right now, we’re in for multiple decades of pain in the pocket-book.

Consider these facts – not ideas, not possibilities, but facts.

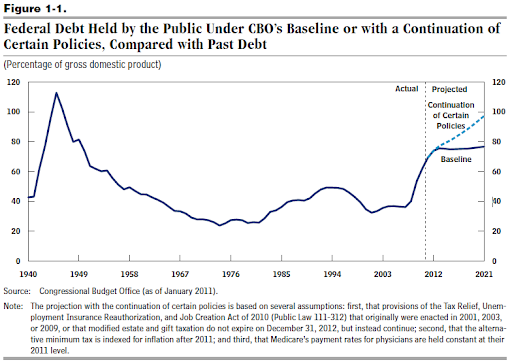

The Congressional Budget Office forecast the following deficit growth figures last year:

In CBO’s current-law baseline, the deficit is projected to equal 9.8 percent of GDP in 2011, shrink to 4.3 percent of GDP by 2013 (after certain tax provisions are scheduled to expire and the economy has recovered further from the recession), and then range between 2.9 percent and 3.4 percent of GDP through 2021 – a little above the average of 2.8 percent seen over the past 40 years. Those deficits would push total debt held by the public to 77 percent of GDP by 2021. CBO’s baseline projections are predicated on the assumption that many policies now in place will be allowed to expire over the next decade, as scheduled under current law. If, instead, those policies were extended, budget deficits would be much larger than in the baseline. As an example, if many provisions of the 2010 tax act were extended rather than being allowed to expire on December 31, 2012, and if the alternative minimum tax (AMT) was indexed for inflation, annual revenues would average about 18 percent of GDP through 2021 (equal to their 40-year average), rather than about 20 percent as shown in CBO’s baseline. If, in addition, Medicare’s payment rates for physicians’ services were held constant, rather than dropping next year as scheduled under current law, deficits from 2012 through 2021 would average about 6 percent of GDP – compared with 3.6 percent in the baseline – and the deficit in 2021 would equal 6.6 percent of GDP (see Figure 1-3). Annual deficits would total nearly $12 trillion over the 2012-2021 period, rather than $7 trillion, and debt held by the public would be 20 percentage points higher in 2021, reaching 97 percent of GDP.

Congressional Budget Office deficit projections (click the graph for a larger view)

There’s more detail in the full report. Bold print is my emphasis. However, the deficit expressed as a percentage of GDP doesn’t jump out and slap you in the face the way the raw figures do. Read the above extract again. Under the best possible scenario, unless something is done to change the picture, the deficit (currently standing at over $14 trillion) will increase by a further $7 trillion over the next decade. Under the worst (yet more likely) scenario, it will increase by a further $12 trillion over the next decade.

Both President Obama and Rep. Paul Ryan have recently advanced proposals to reduce the growth in the deficit over the next ten to twelve years. Note that they haven’t proposed to reduce the deficit overall – merely the speed with which it grows! Under the President’s plan, $4 trillion would be cut over 12 years; and under Rep. Ryan’s plan, about $5 trillion would be cut. Nevertheless, under the CBO’s optimistic projection, that would still mean that the deficit would grow by between two and three trillion dollars over that period. Under its most pessimistic projection, the deficit would grow by between seven and eight trillion dollars. There would be no actual deficit reduction whatsoever under either proposal.

To call this “insane” is the understatement of the year! We can’t live with our deficit at its present level, never mind driving it even higher! That’s why Standard & Poor’s just downgraded its rating of US Treasury securities from ‘stable’ to ‘negative’. S&P can see the writing on the wall . . . as can anyone with half an (economic) eye for reality. Nor is that agency alone in possessing good fiscal eyesight. As Chris Martenson points out:

The US budget process is entirely out of control. By extension, its fiscal future is rather bleak.

All one has to do is back up two steps, entirely ignoring the meaningless budget scuffles currently ongoing in DC, to see that the federal government’s fiscal situation is in complete shambles. In fact, as things currently stand in terms of spending and revenues, the US government is insolvent – its liabilities vastly exceed its assets on a net-present-value basis.

Yes, Obama has just laid out a plan that calls for cutting some $4 trillion of new, incremental deficit additions over the next 12 years, but this merely obscures the fact that the deficit will still grow by a rather hefty amount nonetheless. Plans from both sides of the aisle call for adding more debt but at a slower pace. True, that’s progress of a sort, but not the type of progress you want to bring home to meet your mother.

For anybody who is even a casual student of history or has paid the slightest bit of attention to what has transpired for Greece, Ireland, Portugal, and other countries with an unrestrained tendency to spend more than they have, it is clear what the progression of events will be for the US.

First there will be a fiscal/funding crisis that will originate in the bond market, specifically the US Treasury market. Interest rates will shoot up, and either austerity will be imposed on the US in a rather unpleasant and draconian way (the bond market is rather remorseless), or it will be self-imposed (not very likely). My estimations indicate this process will begin before the end of 2012.

Next, if the US fails to heed the edicts of the bond market and tries to maintain spending in the face of rising interest rates or print its way out of trouble, the risks increase that the US dollar will suffer a major decline. Let’s say that this process will begin a year after the start of the fiscal crisis.

That’s all there is to it. A fiscal crisis possibly (probably?) followed by a currency crisis – all initiated by a leadership crisis.

How long it will take the markets to wake up to this simple progression is anybody’s guess. Here we must fall back on a simple maxim that has served us well: Anything that is unsustainable will someday stop.

Last year, the US was not unique in its fiscal and economic woes.

This year, the US has distinguished itself by being the only advanced economy to increase its underlying budget deficit in 2011, according to the IMF.

There’s more at the link.

It’s not just US public debt that’s the problem. The Treasury will continue to try to finance US spending by selling securities on the open market; but the competition for investors’ funds is going to be very, very tough over the next few years. The International Monetary Fund has just warned that the world’s banks are facing a huge challenge – one so great it threatens global economic recovery.

The world’s banks face a $3.6 trillion (£2.2 trillion) “wall of maturing debt” in the next two years alone, but must compete against governments to secure new financing, the fund said.

“These bank funding needs coincide with higher sovereign refinancing requirements, heightening competition for scarce funding resources,” the latest global financial stability report from the IMF warned.

There’s more at the link.

So the world’s banks will be competing with sovereign states to attract funds. It’s going to turn into a bidding war, with all parties having to offer more (i.e. higher interest rates) in order to lure investors. Even that may not be enough, simply because there isn’t enough money looking for an investment home to buy all the securities that will be offered. As Zero Hedge points out under the headline “The Breakdown Draws Near“:

In order for the financial system to operate, it needs continual debt expansion and servicing. Both are important. If either is missing, then catastrophe can strike at any time. And by ‘catastrophe’ I mean big institutions and countries transiting from a state of insolvency into outright bankruptcy.

. . .

When both big banks and sovereign entities are simultaneously facing twin walls of maturing debt, it is reasonable to ask exactly who will be doing all the buying of that debt? Especially at the ridiculously low, and negative I might add, interest rates that the central banks have engineered in their quest to bail out the big banks.

. . .

With Japan now focusing on rebuilding itself, and China seemingly now in the grips of a housing bust that could prove to be one for the record books, given the enormous price-to-income gap that was allowed to develop, it would seem that the financing needs of the West will not be met by the East.

. . .

With the Fed potentially backing away from the quantitative easing (QE) programs in June, the US government will need someone to buy roughly $130 billion of new bonds each month for the next year. So the question is, “Who will buy them all?”

Right now, that is entirely unclear.

There’s more at the link. Bold print is my emphasis.

To make matters worse, by “printing money” through its program of “Quantitative Easing“, the Federal Reserve has jump-started inflation in the US and devalued our currency on overseas markets. Already the value, or purchasing power, of the dollar has slumped in relation to other major currencies. As Karl Denninger says:

… the dollar is now sitting within spitting distance of its all-time low. There is no floor beneath that level on a technical basis. While an “underthrow” excursion might well be tolerated, should there be any meaningful and sustained break below about 71.5 on the /DX you’re not going to have to worry about what comes next – you’re going to be treated to it immediately with $150/bbl+ oil, gas north of $5 and literal privation and hunger in the streets of America, as it becomes impossible for the government to hand out money faster than currency devaluation steals it. Shortly thereafter S&P will downgrade and then we’re find out if we’re Greece, Egypt, or (far worse) Libya.

Most people in the lower economic brackets are a few percentage points in the increase of their cost of living from literal starvation or inability to pay for other basic necessities such as the heat and water bill. There is no margin for these folks, and yet we’ve already effectively doubled the price of gasoline in the last year alone, not to mention the price of corn, cotton and more. While some of those agricultural commodities have come in on price over the last couple of weeks they remain at ridiculously-elevated levels – double or more where they were a year ago.

NEARLY ONE HALF OF AMERICA IS IN THIS POSITION TO SOME DEGREE, AND MORE THAN A QUARTER OF ALL AMERICANS ARE UTTERLY UNABLE TO ABSORB THE COMMODITY RAMPS THAT HAVE ALREADY TAKEN PLACE, SAY MUCH LESS THOSE THAT ARE TO COME IF THE GOVERNMENT AND FEDERAL RESERVE POLICIES CONTINUE.

Again, more at the link.

I won’t go on, for fear that my readers will come to regard me as a cross between a Jonah and a Cassandra, and not bother to return. Nevertheless, I can’t urge you strongly enough to read the articles to which I’ve linked above; read more widely about the issue; and take what precautions you can. Our elected leaders simply aren’t treating this crisis with the seriousness it deserves . . . and we’re all going to suffer as a result, when the crunch comes.

Peter

You are urging us to take what precautions we can, and I've been thinking this too, but I'm not sure what all to do. I'm growing my garden, and am going to try to preserve more than I usually do. What else do you think we should do?

Fair question, Hydrogeek. I'll put up a post this evening with some suggestions.

Garden is sort of a pointless wash here in New Mexico. But stockpiling canned food is a good idea.

Hydrogeek, don't miss the opportunity to educate yourself. I've taken up gunsmithing, I study small unit tactics, and have been collecting hand tools for a while now, as well as learning how to use them.

Get in shape. I have a demanding job schedule, but that is on my plate now. If the poo hits the fan, I want to be in good enough shape to survive the shock and deal with the aftermath.

Metals are a good investment, but gold and silver are about out of my reach now. I'm gathering lead and steel as I can.

Lots to do… no time to wring your hands.