There have been a number of insightful articles in recent weeks that have started me thinking again about the world economy. I’ve analyzed it often on this blog in recent years, and haven’t seen much reason for optimism. These recent articles have shed new light on a few things I’ve noticed and written about, and added new concerns.

A basic principle of economics is that money has value because there isn’t enough to go round, but as governments keep creating more of it, the rules may be starting to change.

. . .

The greater the threat to the financial system (Turkish coup, anyone?) the more likely central bankers will propose to create more money.

There is an odd thing going on in global economics right now that’s very hard to grasp because it’s outside our day-to-day experience, and it’s contrary to the founding paradigm of conventional economics: the world’s central banks are increasingly making money valueless.

As I’ve mentioned before, it may be possible to adapt to a world where capital is free, but if so, the rules must change radically.

Among the conventions of economics, the idea that money is in short supply is near the top of the list. But if the value of money is zero or negative, many of the rules go out the window.

If governments produce all the money needed for finance, why should retired people expect interest on their savings? After all, interest is someone paying you for your scarce money. Why pay if it’s not scarce?

Far more revolutionary, why should rich people — those who have somehow captured large chunks of money — profit from something that’s being created, free, by governments, while so many other citizens get a much lesser benefit?

There’s more at the link.

This has huge – I say again, HUGE – implications for investors large and small. Let’s put it in terms relevant to us as individuals. We’re told to save for retirement; but what if the interest rate on our savings is so low that it’s less than the rate of inflation? If we leave our money in savings accounts or IRA’s, we’re effectively losing money on it.

In particular, with governments manipulating the ‘official’ rate of inflation so as to limit inflation-indexed spending (e.g increases in entitlement payments, Social Security, etc.), we can no longer rely on the ‘official’ numbers for planning purposes. (I examined this in detail a few years ago.) The current reality of inflation is dire. I’ll give you two examples.

First, from Shadowstats (which we’ve met in these pages before), two charts. The upper calculates inflation according to the standards used in 1990, the second those of 1980. Compare both lines to the standards currently in use, and you’ll get a very good idea of how the ‘official’ numbers have been deliberately skewed in order to make the ‘official’ rate of inflation appear lower than the economic reality. (You can learn more about why they’re doing that here and here.)

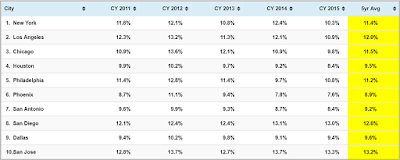

Second example: the Chapwood Index calculates actual (not theoretical) inflation rates for specific cities in the USA, using a standardized basket of goods as a hard measurement of year-on-year price increases. It’s very hard to ‘fudge’ that sort of calculation. Here’s Ed Butowsky, founder of Chapwood Investments, explaining what he does and why. The video dates from August 2013, and the figures quoted in it are accurate for that period.

Here’s an example of ten cities analyzed by the Chapwood Index, taken as a screen-shot from their Web site this morning. (Click the chart for a larger view.)

Note that the 5-year average annual rate of inflation, averaged across those 10 cities, is 10.91% – let’s round it up to 11%, for convenience. The Chapwood Index thus indicates an even higher city-specific inflation rate than the Shadowstats calculations. There’s an easy way to check their calculations for yourself. Compare the cost of a shopping trolley full of goods that you used to buy at the supermarket ten years ago, with the cost of that same trolley full of goods today. For almost anyone in the USA, it’s probably at least doubled, if not more so, hasn’t it? That indicates a real, compound inflation rate of at least 10% per year as experienced by consumers like you and I – and demonstrates in real life that Shadowstats and Chapman’s calculations are far more accurate than the ‘official’ statistics.

Compare that real rate of inflation to the risible rates of interest you’re being offered by the banks. They range from fractions of one per cent up to a couple of per cent per year (the latter only for really big deposits). On the other hand, inflation is eating the value of your deposit at five to ten times that rate every year. What’s even worse is that you have to pay tax on your interest earnings, so your return on your savings is even lower than that. It’s no longer worth leaving money in the bank except as a safe deposit facility for short-term use. Apart from the safety aspect, you may as well keep cash at home (and if the bank should fail, you’ll definitely be better off with cash at home, since your bank deposits are likely to be ‘bailed-in’ to save the bank!).

In the light of those real inflation figures, let’s go back to Don Pittis’ remarks quoted above:

Among the conventions of economics, the idea that money is in short supply is near the top of the list. But if the value of money is zero or negative, many of the rules go out the window.

If governments produce all the money needed for finance, why should retired people expect interest on their savings? After all, interest is someone paying you for your scarce money. Why pay if it’s not scarce?

That’s precisely the point. The artificial ‘creation’ of money (merely binary zeroes and ones in an official computer system somewhere) means that there’s no economic value underlying that currency. It’s ‘funny money’ in the un-funniest sense of the world. If it can be created out of thin air, with no assets underpinning it, is there any wonder that the real inflation rate is so much higher than what officialdom would have us believe? The value of our money is being deliberately undermined each and every year. Inflation is merely a way to measure that officially-sanctioned and deliberately-caused reduction in value.

What’s more, on top of inflation, globalization has contributed to a fall in real income levels across the lower- and middle-income sections of our society. Thus, our already inflation-ravaged incomes have been even further reduced, to the benefit of a small upper-income slice of our population, and poorer nations abroad. They have every reason to be grateful for globalization. Apart from the flow of cheaper goods to our supermarkets, we have rather fewer reasons for gratitude. Globalization has cost the average American and European a lot of money in terms of lower and/or lost earnings.

The impact of (real) inflation and globalization has led to people seeking better returns on their investments, by turning to the stock and bond markets, and to assets such as property. However, all is far from well there too. Central banks now own large parts of their countries’ private corporations, as they’ve bought up bonds in an effort to stimulate economic growth. They’ve also guaranteed loans and other financial instruments to aid companies (and entire sectors of their economies) that are in trouble. Combined, those measures have led to a stealthy and possibly unintended form of partial nationalization, although they’d never refer to it as such – and it’s having the same unhealthy effects on the economy.

Let’s face it: if a government – through its central bank – owns large parts of a nation’s productive capacity, or owns or guarantees the debt (i.e. bonds and loans) owed by that productive capacity, it’s going to face irresistible pressure to take economic measures that favor the productive capacity it owns, at the expense of other parts of the economy and of its trading partners. That’s one of the factors that’s led to so-called ‘currency wars‘ all around the globe, as well as countries with cheaper manufacturing costs ‘dumping‘ their products on those with higher costs of production. (China is a particularly egregious offender in this regard at present.) The effects of those practices are currently affecting trade all around the world. Local businesses can’t compete price-wise with such low-cost imports. That means more local workers lose their jobs as employers are forced to cut back.

What will these pressures lead to? What can central banks do to ‘fix things’ that they are not already doing? And what can we, as individuals, do to prepare for the risks these factors are bringing with them? That’ll be discussed in a second part to this article, later today or tomorrow.

Peter

The artificial creation of money is the textbook definition of inflation the change in prices is the measure of how much damage that inflation has done to real asset values. The real devil is in the details of who gets the use of the new "money" and in what order. The artificial money creates illusions of opportunity that encourage unsustainable enterprises and projects. When the resources and demand fall short those enterprises fail those new factories sit idle jobs are not sustainable. New money injections can mask the problem but at some point hyperinflation sets in and nothing short of new sound, not fiat, currency can halt the collapse. Weimar germany is a small scale example others are common enough. My fear is that the inflation is now so widespread and beloved by state bankers whose only thought is for today, tomorrow is coming and the great depression of the thirties was the result of only a small boom bust cycle.

Did we, as the U. S., help this slow-moving train along with our 2008 mortgage disaster? Was Obamacare already written, ready for the public, with the idea in mind that we, as the wealthiest nation, would be stripped financially, with the Fed waiting in the wings to help us in our disaster? Each country would have its reasons, and self-serving plans ready for execution. I realize it sounds silly, but if you look at it from a very simple, uncomplicated, math problem, it might not be so difficult to unravel. The pension issue is the largest issue affected, and no matter how much money retirees, or future retirees, try to save, they would be blocked by something so simple as a zero interest rate – Communist Manifesto #2 and# 5. Look around and see what is happening in Japan, China, Russia, and especially the EU. Look at the United States of America and who is running. How long has the Clinton machine been trying to collect and stash money? The more they have, the less their worry about low interest rates; they can outspend any obstacle. Oh, well ….. 🙂

I once read an article by a fellow living in a South American country with rampant inflation. The way they dealt with it was to take money, as soon as they got it, and buy durable goods which would continue to be in demand (machinery, tools, storable foods, etc.) Then, when they needed cash, they'd sell those items at the then inflated prices to pay or buy what they needed, and IMMEDIATELY put any left-over cash back into durable goods.

The flight of capital to durable goods at all levels is a sign of the collapse of confidence in the currency and the only way to save wealth when the "money" is worthless. It is also a good indicator of how close you are to total meltdown. It also illustrates why stable money is an essential economic lubricant.

As you imply, but don't say succinctly, the central banks are in the process of destroying "Money". It's possible they've already succeeded, with $13 Trillion of the world's debt now paying negative interest rates. Buyers pay the bond sellers for the privilege of loaning them money? What if those buyers decide not to buy that debt? The central banks are just so institutionally blinded by their theories, they can't see that what they're digitally creating isn't money because money is finite, and ultimately money is time; wealth is learning, wealth creation uses time. The banks are creating bogus accounts that really mean nothing – except when people/groups compare the size of the numbers in their accounts.

When people realize it's not really money, and that everything they've saved all their lives has been destroyed, more than a few are going to be a bit peeved.