Charles Hugh Smith highlights two charts from the Federal Reserve that sum up, in the most graphic fashion (literally and figuratively), why all the arguments about Republicans versus Democrats, or socialism versus capitalism, or anything else, are less and less relevant to reality. Both parties have mismanaged our economy to such an extent that we’re no longer able to avoid the economic hard times bearing down on us – and when they arrive, we won’t be able to afford either party’s pet policies.

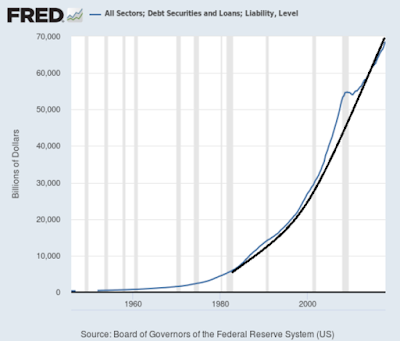

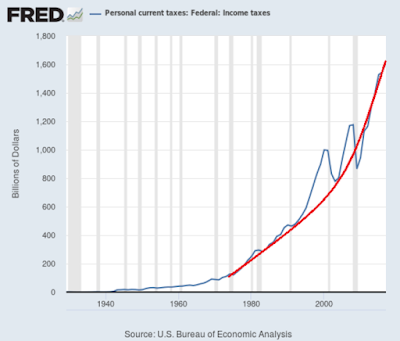

Take a look at these charts of total liabilities/debt and federal income tax collected and ask yourself: are these trends sustainable in an economy growing by a few percent a year? [Click both images for a larger view.]

Federal income taxes collected have practically doubled from the recessionary nadir of 2009: does anyone really think they can double again in the next 9 years?

These geometrically rising trendlines are the acme of unsustainability. The limits have been reached and reversal looms. Ask yourself why multiple bids for real estate have vanished and why the Fed is so anxious to publicly trumpet its dovishness. If the limits were far from being reached, why the tone of desperation?As I noted yesterday, every injection of stimulus weakens the response of the following dose. After a decade of never-ending stimulus, the positive effects of stimulus have been exhausted. Increasing the stimulus is toxic to an exhausted system pushing its intrinsic limits.

There’s more at the link.

Those charts say it all. The pattern they portray is simply unsustainable. It cannot continue: and, as economist Herbert Stein famously pointed out, in the “law” of economics named for him: “If something cannot go on forever, it will stop.”

The evidence for this, the fruit of the policies portrayed in those graphs, is all around us – but most of us are refusing to see it, because we’d rather ignore it. I cite the following recent headlines as evidence:

- Record 7 million Americans are 3 months behind on car payments, a red flag for economy

- Telltale Signs of Recession

- More than 1,500 stores are expected to close this year — here’s the full list

- The Hidden Automation Agenda of the Davos Elite (which has huge implications for the job market, and hence for the need for government support programs – go read all about it)

I’ve said it many times before, most recently just last month. I’ll say it again. Get ready for hard times. They are coming, despite all the froth and bubble on the surface of the economy. If you think they’re not . . . go look at those graphs again. Mathematics is an exact, hard science. There’s nothing fuzzy or wishy-washy about it. The numbers don’t lie . . . and those numbers are scary as hell.

It doesn’t matter who’s in the White House, or which party controls Congress, or how much we’re spending on defense, or whether or not we have illegal aliens coming across our border. All of those issues are going to be swamped by the economic reality bearing down on us, whether we like it or not – and neither Democrats nor Republicans, and certainly no leading politicians of either party, have shown any understanding of, or commitment to, solving the real problem.

Peter

yes….but this is the same argument that has been in place since the 80's.

So I guess one could have followed this advice – get defensive, prepare for the zombie apocalypse, etc etc- a couple /few decades ago…and have missed out on a lot of fun, life, and money.

I'm being serious here. And I agree with you and I think Krugman is a political hack worm masquerading as a real economist. I agree that the world will end and that all this debt will end badly. I believe in all that. I understand.

But…when? in 1 yr, 3, 5, 10, 20, our lifetimes?

I'd bet that you were like me and when in 08/09 bailouts were happening and balance sheets ballooning that you said " this will be terribly inflationary in the future" and by future you meant like 5-10 years MAX. I made a bet with a friend in 2008 . I said the 10 yr T would be 10% or greater within 10 yrs….bc of all the financial shenanigans going on. I lost that bet. Bad.

So…my point is things CAN and DO go on for a LOT longer than you think.

That and we tend to underestimate human ingenuity.

Today IS the best period of time to have ever lived. And I could show you various charts to prove it ( like those Fed data you present here) .

Just something to think about.

@Houston: I would argue that you actually won your bet. Inflation right now, if measured accurately, is actually pretty close to 10%. See:

https://bayourenaissanceman.blogspot.com/2019/01/a-level-headed-sober-view-of-us.html

If the 10-year T-bill rate were tracking inflation (as it should), it should by now be at that level or more. It's only because inflation has been deliberately under-calculated by the government for many years that it isn't.

Yep. I agree that its not measured in what Id consider an appropriate manner.

Still one would think that the bond market finance wizards worldwide arent idiots and are in it to make profit….and while sure the central banks across the world are heavily influencing bond prices…I'd still expect the bond market to reflect this "inflation", no? Also those same bond market gearheads have access to TIPS as well so maybe you'd see a blow out in the tips -T spread or whatnot. But none exists. Bond buyers are still lapping up huge quantities of Ts and thus yields remain low. Curious I'd say.

Economic problems come and go, and the nation perseveres.

If we are replaced as a people, the nation disappears.

Nothing is as important as curbing immigration.

Of course tax revenues can double in another 9 years. That's what inflation is for.