Well, we do business with China because they’ve become the world’s manufacturing hub, and they’ve bribed so many Congressional representatives and Senators and businessmen that they’ve bought their way in . . . but that doesn’t mean we have to put up with this sort of thing. China tried to build a network of… Continue reading Why do business with China when they do things like this?

Tag: Economics

When “going green” means an energy drought

Mish Shedlock sums up Germany’s energy dilemma. Angela Merkel mothballed nuclear power plants to appease the Greens. The Nord Stream II natural gas pipeline is ready to deliver gas but is totally shut down due to sanctions. Nord Stream I needs repairs but sanctions limited availability of parts. Rather than put the nuclear plants… Continue reading When “going green” means an energy drought

This may make US borrowing much, much more expensive

Until very recently, the US dollar has been the only reserve currency trusted by most of the rest of the world. That’s helped us sell US treasury bonds to other nations, and to investors, because the dollar’s status has been a guarantee of its ongoing security and trustworthiness. However, the Federal Reserve’s incontinent printing… Continue reading This may make US borrowing much, much more expensive

“Money talks, bull**** walks”

I note with interest – and concern – a step that’s a very clear forecast of what lies ahead for consumers in the US economy. Wells Fargo & Co said on Friday its second-quarter profit nearly halved as the bank set aside more funds to cover potential loan losses, while its mortgage lending business… Continue reading “Money talks, bull**** walks”

Saturday Snippet: A 19th-century view of money, interest and investment

Today’s Snippet is from a book that’s not yet published. It’s “The Price of Time: The Real Story of Interest” by Edward Chancellor. Financial and investment analyst John Mauldin has been publishing excerpts from the book in his free weekly newsletter “Thoughts From The Frontline“. (If you’re not already subscribed to it, I highly… Continue reading Saturday Snippet: A 19th-century view of money, interest and investment

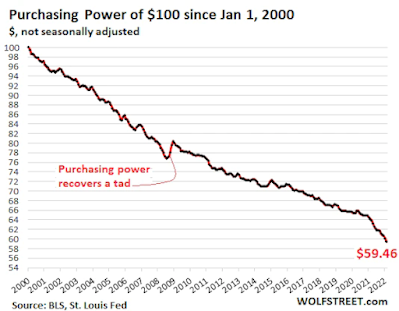

What’s a dollar or two between friends?

The latest inflation figures are bad enough – an annualized rate of 9.1%. That figure is, of course, illusory, and bears little relation to reality. The real annual inflation figure (which the government is carefully not mentioning at all), using my suggested correction factor of 3.5 times the “official” numbers and rounding the result, is… Continue reading What’s a dollar or two between friends?

The reason why the London Metals Exchange “blew up in March”

There’s an old saying that if you owe the bank $1 million, you have a problem. However, if you owe the bank $100 million, the bank has a problem. That appears to have been behind the London Metal Exchange‘s unprecedented actions during March this year, when they effectively defrauded dozens, perhaps hundreds of independent… Continue reading The reason why the London Metals Exchange “blew up in March”

An inflation vacation

Here’s how Stephan Pastis sees it in his “Pearls Before Swine” comic strip. Click the image to be taken to a larger version at the comic’s Web page. I’ve had holidays like that . . . Peter

Inflation watch: You’re on your own. Nobody is coming to save you.

One of the scariest things about our current high-inflation environment is the number of people I meet who keep on thinking (and saying) that “Somebody must do something!” I’m not sure who that “somebody” is supposed to be (most seem to assume it’ll be the government), or what, precisely, they can do to fix… Continue reading Inflation watch: You’re on your own. Nobody is coming to save you.

“This recession will be unlike any other”

That’s the grim warning from Charles Hugh Smith. He identifies five factors that cause and/or contribute to economic troubles: 1. The business cycle … In [a] confluence of greed and euphoria, people over-borrow and put the money into marginal investments and speculations that unravel. Defaults rise, credit tightens, the mood sours and profits tank.… Continue reading “This recession will be unlike any other”